The Board is also cognisant of the benefits of the Companys investment trust structure which enables it to retain up to 15 of total revenue each year to build up reserves which may be carried forward and used to pay. The benefit or expense under such arrangements is calculated based on the amount of losses absorbed by taxable income multiplied by the statutory rate of.

Public Ruling No 5 2015 Taxation Of Limited Liability Partnership 营商攻略

Iras Gov Sg

Consolidated Group Tax Allocation Agreements The Cpa Journal

This amount is absorbed and the remainder carried forward to offset future years net income.

Losses absorbed by other statutory income in current year. A Except for nonqualified pension plans pension costs see 48 CFR9904412-40a1 assigned to the current accounting period but not funded during it are not allowable in subsequent years except that a payment made to a fund by the time set for filing the Federal income tax return or any extension thereof is considered to have been made during such taxable year. 81 In terms of Section 43D of the Income Tax Act 1961 income by way of interest in relation to such categories of bad and doubtful debts as may be prescribed having regard to the guidelines issued by the RBI in relation to such debts shall be chargeable to tax in the previous year in which it is credited to the banks profit and loss account or received whichever is earlier. 1 In the typical contemporary Congress several bills are introduced to.

A1 Aggregate statutory income from businesses and partnerships 00. The required percentage. To offset for tax purposes one periods loss against a subsequent periods net income.

Net operating losses may be carried forward indefinitely until absorbed. Consolidated Statement of Other Comprehensive Income. Banca Monte dei Paschi di Siena SpA.

The loss would be includable in QBI in that year if it were not fully limited by section 469 passive activity loss limitations. Stay informed 247 about every update of the whole ordering process. Such tax benefits may enhance the value of a target to a buyer burdened with high taxes.

You can carry the remaining 800 to future years until it expires or is absorbed. This is particularly true in the current environment where low interest rates are likely to persist for some time and investors are struggling to maintain income levels. As at As at 30 June 2020 31 December 2020 unaudited audited GBP GBP Note Assets Non-current assets Property plant and equipment - 168 Total non-current assets - 168 ----- ----- Current assets Trade and other receivables 5 26823 25085 Cash and cash equivalents 522656 345200 Total current assets 549479 370285 Total assets 549479 370285 ----- ----- Equity and liabilities Equity.

Rebecca is an expert in personal finance business and financial markets. The Code of Federal Regulations CFR is the official legal print publication containing the codification of the general and permanent rules published in the Federal Register by the departments and agencies of the Federal Government. Other Matters to be.

The audited statutory accounts for the year ended 31 December 2020 have been delivered to the Registrar of Companies in England and Wales and are publicly available on the Companys website. ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero. 25 We use the estimated model to obtain predicted probabilities of being exposed to minimum wage increases for all individuals.

Look over the writers ratings success rating and the feedback left by other students. 73 of Americans get to the top 20 of income for at least 1 year of their lives. Accordingly management should select the period most appropriate in the circumstances.

Students should ensure that they reference the materials obtained from our website appropriately. The 20000 loss is not included in the calculation of taxable income in the year generated so it is not included in As QBI for that year. The 2017 Tax Law generally retains the existing subpart F regime that applies to passive income and related-party sales and services income and it creates a new broad class of income global intangible low-taxed income GILTI that is also deemed repatriated in the year earned and thus is also subject to immediate taxation.

The federal government has employed government corporations to achieve policy goals for over a century. Low-income countries tend to have a higher dependence on trade taxes and a smaller proportion of income and consumption taxes when compared to high-income countries. The other fact that gets overlooked is very income level are fluid throughout someones life and very very few stay in the top 1 for very many years.

Losses which are unused may generally carry over to another year. Year to Year to 31 July 2021 31 July 2020 GBP000 GBP000 -----. Income from all real estate owned for each of the prior and current fiscal years shall be at least 5 higher in the current fiscal year than in the.

We double-check all the assignments for plagiarism and send you only original essays. A custom essay writing service that sells original assignment help services to students. Locate current and prior year tax forms and publications.

Rebecca McClay has 10 years of experience writing and editing content. The Electronic Code of Federal Regulations eCFR is a continuously updated online version of the CFR. You hold an S corporation interest in a Florida S corporation that reports income and losses on a fiscal year ending May 31st of.

Peggy James is a CPA with over 9 years of. Email and SMS Notifications. The income tax charge in the current year and the credit in the prior year relate to the actuarial gains and losses respectively on the St Ives Defined Benefits Pension Scheme.

Under IRC 6654 Failure by Individual to Pay Estimated Income Tax payment of tax either through withholding or by making quarterly estimated payments must equal the lesser of 90 percent of total liability for the current year or 100 percent of the taxpayers tax liability for the prior year ie. In addition management in making a projection should disclose what in its opinion is the most probable specific amount or the most reasonable range for each financial item projected based on the selected assumptions. 64 One indicator of the taxpaying experience was captured in the Doing Business survey 65 which compares the total tax rate time spent complying with tax procedures and the number of payments required through the year.

We provide essay writing services other custom assignment help services and research materials for references purposes only. Among Members of Congress the executive branch and the scholarly community interest in the government corporation option and variations on this class of agency has increased in recent decades. These interim condensed financial statements do not comprise statutory accounts within the meaning of section 434 of the Companies Act 2006.

Business losses brought forward Restricted to A100 A3 TOTAL A1 A2 00 A4 Aggregate statutory income from other sources Dividends interest discounts rents royalties premiums other income and additions pursuant to paragraph 431c 00. ˈbaŋka ˈmonte dei ˈpaski di ˈsjɛːna known as BMPS or just MPS is an Italian bankTracing its history to a mount of piety founded in 1472 549 years ago and founded in its present form in 1624 397 years ago it is the worlds oldest or second oldest bank depending on the definition and the fourth largest Italian. It is not an official legal edition of the CFR.

Only 06 will stay in the top 1 for 10 consecutive years. Such regulations lay down the rules on how to resolve disputes between the interpretation and application of agreements and conventions that provide for the elimination of double taxation of income between Malta and other member states. We use observations from three years prior to the 138 events that also lie outside any of the five-year post-treatment windows and estimate a linear probability model of having a wage less than 125 of the statutory minimum wage on a rich set of demographic predictors.

The rental property generates a 20000 net loss in the current tax year. Other companies may not have a reasonable basis for projections beyond the current year.

Consolidated Group Tax Allocation Agreements The Cpa Journal

Lampiran1 Hasil Gov My

For Asia Pacific Banks Covid 19 Crisis Could Add Us 300 Billion To Credit Costs S P Global Ratings

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

1

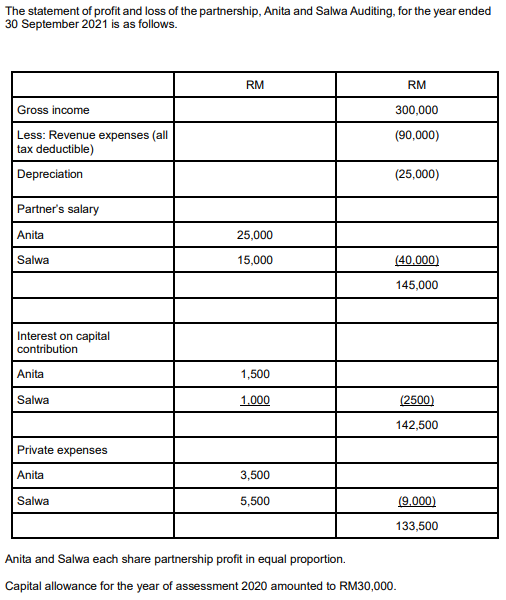

Solved Required A Compute The Statutory Income In Respect Chegg Com

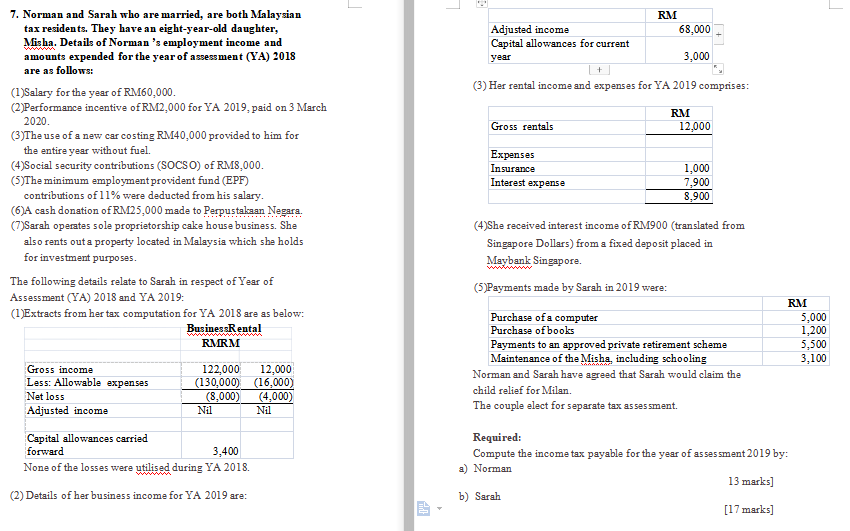

7 Rm 68 000 Adjusted Income Capital Allowances For Chegg Com

Opentuition Com